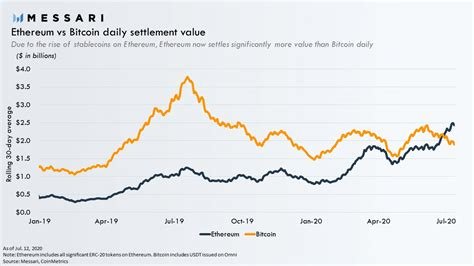

Ethereum: Could there be a dollar version of bitcoin?

The Quest for a Dollar-Backed, P2P Ethereum Alternative: Can We Create a New Currency?

In the world of cryptocurrency, one thing is clear: Bitcoin has been a game-changer. Its decentralized nature, security, and wide acceptance have made it a benchmark for alternative currencies. However, as we continue to explore new possibilities in the realm of digital assets, a question remains: can there be a dollar-based version of Bitcoin? In this article, we’ll delve into the challenges of creating such an alternative and examine why a P2P software that loads with dollars might not be feasible.

Why Can’t There Be a Dollar-Based Bitcoin Alternative?

Bitcoin’s success is largely due to its decentralized architecture and cryptographic algorithms, which ensure that transactions are secure, transparent, and unalterable. These characteristics make it difficult to imagine a dollar-based version of the cryptocurrency without compromising on these fundamental aspects. Here are a few reasons why:

- Centralization of wealth: Bitcoin’s value is heavily tied to the wealth of its users, who hold private keys that can be used to send and receive transactions. This centralization creates an inherent risk, as centralized authorities could manipulate the supply of Bitcoins or freeze accounts.

- Decentralized consensus: The Proof-of-Work (PoW) consensus algorithm that underpins Bitcoin’s network is designed to prevent a single entity from controlling the majority of the computational power. However, with dollars on board, there would be an increased likelihood of central authorities exploiting this advantage.

- Censorship resistance: Bitcoin’s blockchain is resistant to censorship and tampering, allowing for peer-to-peer transactions without intermediaries. A dollar-based alternative would need to find ways to prevent such censorship, which could be challenging.

Why Can’t Something Be Made That’s Just P2P Dollar Transfers?

While the idea of a P2P dollar transfer system sounds appealing, there are several reasons why it might not work as an alternative:

- Regulatory hurdles: Governments and regulatory bodies around the world have taken notice of Bitcoin and its potential for illicit activities. Creating a regulated, dollar-based system would require significant compliance with existing laws and regulations.

- Scalability concerns: The current P2P network architecture faces scalability issues, particularly when dealing with large volumes of transactions. A new system designed specifically for dollars might struggle to match the efficiency and speed of Bitcoin’s blockchain.

- Interoperability issues: A dollar-based system would need to account for differences in payment processors, wallets, and other third-party services that support Bitcoin. This interoperability challenge could lead to technical difficulties and user experience issues.

Can Something Be Made That’s Just P2P Dollar Transfers?

While a dollar-based P2P system is unlikely to replace Bitcoin or Ethereum anytime soon, there are some potential niches where such a system might make sense:

- Remittances: International remittance systems can benefit from P2P dollar transfers, which provide faster and cheaper alternatives to traditional money transfer services.

- Microtransactions: Small-scale transactions, such as buying snacks or paying for parking, might be well-suited for a dollar-based system that prioritizes convenience over centralization.

- Community-driven projects: Some blockchain-based communities have explored P2P systems as a way to create decentralized networks and exchange currencies without relying on centralized authorities.

In conclusion, while the idea of a dollar-backed, P2P Ethereum alternative seems intriguing, it’s unlikely to replace Bitcoin or Ethereum anytime soon.